Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

Need to raise capital to grow your business? The stock market is a great way for entrepreneurs to do just that. According to Gallup.com, 42.5% of entrepreneurs are buying and trading stocks. If you’d like to take part and start investing smarter, this lifetime subscription to Sterling Stock Picker is currently on sale for $55.19 with code SAVE20 through June 1.

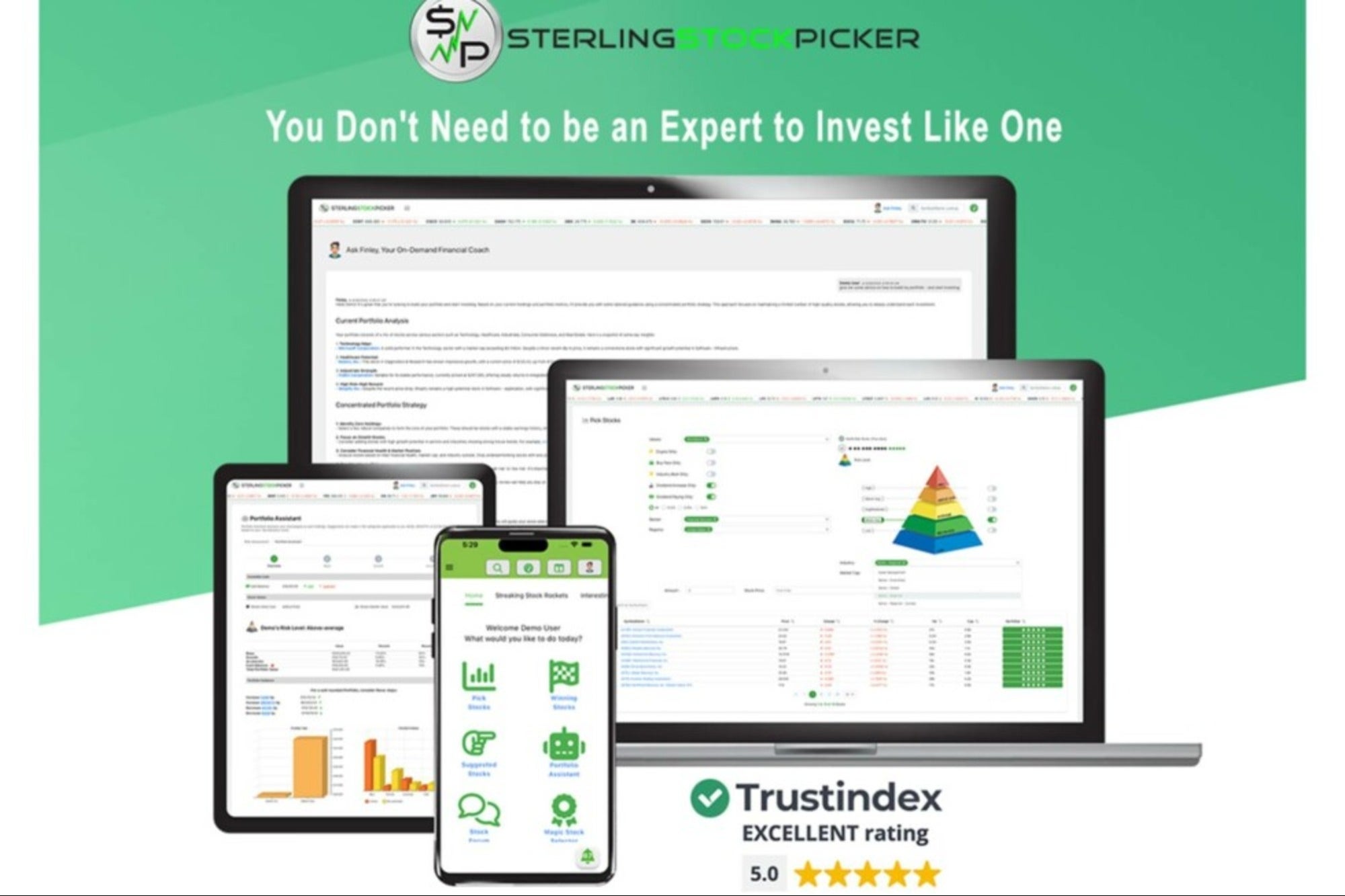

This app makes the stock market accessible for everyone

If you’ve always wanted to use the stock market to your advantage, but haven’t been sure where to start, Sterling Stock Picker is here to help. This award-winning platform was created to make the stock market more accessible to everyone, with no expertise needed.

Sterling Stock Picker uses different methods to select winning stocks for your portfolio, making sure they line up with your personal values, investment preferences, and risk tolerance so that you can make solid decisions. You just take a five-minute questionnaire to get started, and watch as the done-for-you portfolio builder makes investing straightforward.

Their patent-pending North Star technology also gives clear guidance on when to sell, buy, hold, or avoid certain stocks. You’ll also get access to Finley, your very own personal AI financial coach, to help you reach your financial goals. Ask Finley for strategic investment advice, risk assessment, educational support, or questions about your portfolio or the stock market in general.

Real-life user Chris raved about Sterling Stock Picker, sharing, “I have been using the Sterling Stock Picker for almost a year and it has played an integral part in me achieving over a 200% return on my investments.”

Start your own stock market journey with this lifetime subscription to Sterling Stock Picker, now $55.19 with code SAVE20 through June 1.

StackSocial prices subject to change.

Need to raise capital to grow your business? The stock market is a great way for entrepreneurs to do just that. According to Gallup.com, 42.5% of entrepreneurs are buying and trading stocks. If you’d like to take part and start investing smarter, this lifetime subscription to Sterling Stock Picker is currently on sale for $55.19 with code SAVE20 through June 1.

This app makes the stock market accessible for everyone

If you’ve always wanted to use the stock market to your advantage, but haven’t been sure where to start, Sterling Stock Picker is here to help. This award-winning platform was created to make the stock market more accessible to everyone, with no expertise needed.

The rest of this article is locked.

Join Entrepreneur+ today for access.