IBM first used the phrase “new-collar jobs” in 2018 to describe roles where degrees are optional, and instead emphasize skills, certifications, or on-the-job training. These careers, such as a sales engineer or marketing manager, often put practical skills above formal education. And according to new data, the jobs can pay quite well.

Resume Genius recently released a report highlighting the highest-paying new-collar jobs, based on an analysis of U.S. Bureau of Labor Statistics data, automation risk scores from the third-party tool “Will Robots Take My Job?“, and job listings on Indeed to determine if the roles offered remote or hybrid work. The jobs were selected for their high pay (median salary of at least $100,000), absence of a four-year degree requirement, availability of remote or hybrid work, and having less than a 50% chance of being automated by AI.

Related: These Are the 10 Highest-Paying Jobs With the Lowest Stress, According to a New Report

“New-collar roles challenge the idea that a degree is the only path to success,” stated Eva Chan, career expert at Resume Genius, in an email. “By showcasing practical skills, a portfolio of work, or even strong referrals, people can build meaningful, well-paying careers without racking up more student debt or spending years in school.”

While landing a new collar job can be different than a traditional white-collar job, which usually requires a four-year degree, or a blue-collar job, which can involve physical labor with specific skill sets, candidates set themselves up for success when applying to new-collar jobs by earning certifications that match the job, freelancing to gain a strong portfolio of work and exposure, and networking.

Here are the top 10 best-paying, new-collar jobs for 2025, according to Resume Genius.

1. Marketing manager

- Median annual salary: $159,660

- Estimated job growth (2023–2033): 8%

- AI job takeover risk: 39%

2. Human resources manager

- Median annual salary: $140,030

- Estimated job growth (2023–2033): 6%

- AI job takeover risk: 24%

3. Sales manager

- Median annual salary: $138,060

- Estimated job growth (2023–2033): 6%

- AI job takeover risk: 33%

4. Computer network architect

- Median annual salary: $130,390

- Estimated job growth (2023–2033): 13%

- AI job takeover risk: 39%

5. General and operations manager

- Median annual salary: $129,330

- Estimated job growth (2023–2033): 6%

- AI job takeover risk: 36%

6. Information security analyst

- Median annual salary: $124,910

- Estimated job growth (2023–2033): 33%

- AI job takeover risk: 49%

7. Sales engineer

- Median annual salary: $121,520

- Estimated job growth (2023–2033): 6%

- AI job takeover risk: 38%

8. Health services manager

- Median annual salary: $117,960

- Estimated job growth (2023–2033): 29%

- AI job takeover risk: 26%

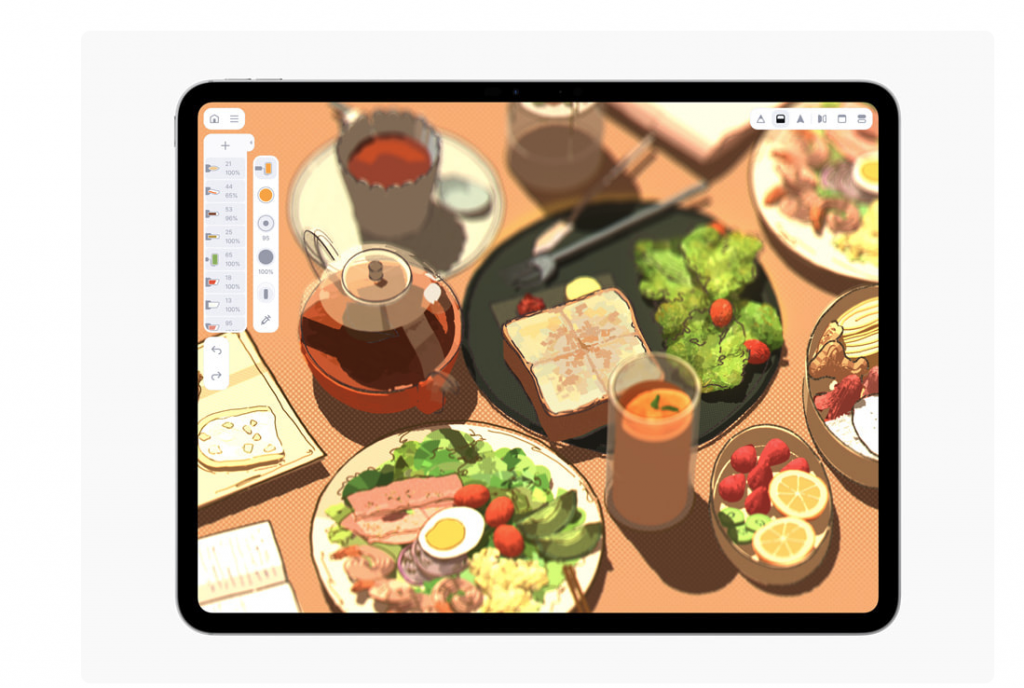

9. Art director

- Median annual salary: $111,040

- Estimated job growth (2023–2033): 5%

- AI job takeover risk: 34%

10. Construction manager

- Median annual salary: $106,980

- Estimated job growth (2023–2033): 9%

- AI job takeover risk: 13%

Click here for the full report.

IBM first used the phrase “new-collar jobs” in 2018 to describe roles where degrees are optional, and instead emphasize skills, certifications, or on-the-job training. These careers, such as a sales engineer or marketing manager, often put practical skills above formal education. And according to new data, the jobs can pay quite well.

Resume Genius recently released a report highlighting the highest-paying new-collar jobs, based on an analysis of U.S. Bureau of Labor Statistics data, automation risk scores from the third-party tool “Will Robots Take My Job?“, and job listings on Indeed to determine if the roles offered remote or hybrid work. The jobs were selected for their high pay (median salary of at least $100,000), absence of a four-year degree requirement, availability of remote or hybrid work, and having less than a 50% chance of being automated by AI.

Related: These Are the 10 Highest-Paying Jobs With the Lowest Stress, According to a New Report

The rest of this article is locked.

Join Entrepreneur+ today for access.

Google CEO Sundar Pichai. Photographer: David Paul Morris/Bloomberg via Getty Images

Google CEO Sundar Pichai. Photographer: David Paul Morris/Bloomberg via Getty Images